What Actually Happens When You Click Buy

You click buy. The button turns green. A confirmation appears. Contracts show up in your account. It seems simple, but it is not. Between your click and those contracts appearing in your account, your order travels through exchanges, algorithms, and market makers, all in milliseconds. Understanding this journey changes how you think about every trade you make.

The first concept to understand is the fundamental choice you face every time you trade. You can have certainty of execution or certainty of price, but you cannot have both. This trade-off drives everything else. Market orders give you execution certainty. Limit orders give you price certainty. Everything else is simply a variation on this theme.

A market order indicates you want in right now and you will accept whatever price is available. You are prioritizing speed over price. Your order will fill. This is essentially guaranteed in liquid markets like ES or NQ, but you are accepting whatever price the market offers at that instant. In fast-moving conditions, the price on your screen might be 4500.00 and your fill comes back at 4500.25. That is the cost of urgency.

When you submit a market buy order, it immediately matches against the best available sell orders in the order book, starting with the lowest ask and working upward until your entire order is filled. If you are buying 5 contracts and there are only 2 contracts at the best ask, your order consumes the next price level, then the next. This is how slippage occurs.

A limit order is the opposite. You are stating that you will only trade at this price or better, and if the market does not come to you, you will wait. You are prioritizing price over execution. You might get a better price than a market order would have provided, or you might not get filled at all. The market does not owe you an execution simply because you want one. Limit orders can sit unfilled for hours while the market moves away. They can also fill at prices that seem impossible, catching moves that market orders would have missed entirely.

Every order you place involves choosing between execution certainty and price certainty. Market orders guarantee execution but not price. Limit orders guarantee price but not execution.

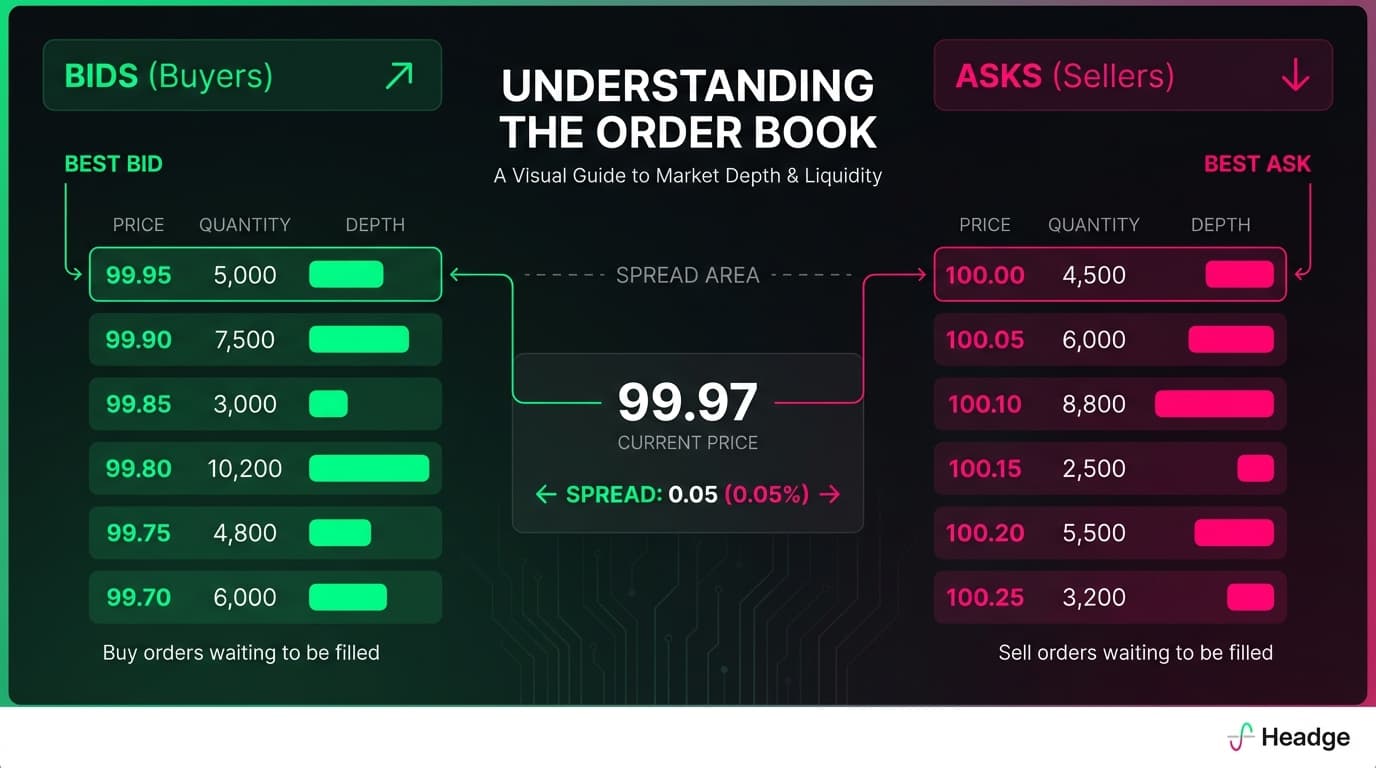

The order book is where all of this happens. It is the central nervous system of price discovery. All limit orders reside there, waiting to be matched. On one side are the bids, limit orders from buyers stacked from highest to lowest. The highest bid is the best bid, representing the most someone is currently willing to pay. On the other side are the asks, limit orders from sellers stacked from lowest to highest. The lowest ask is the best ask. The gap between them is the spread.

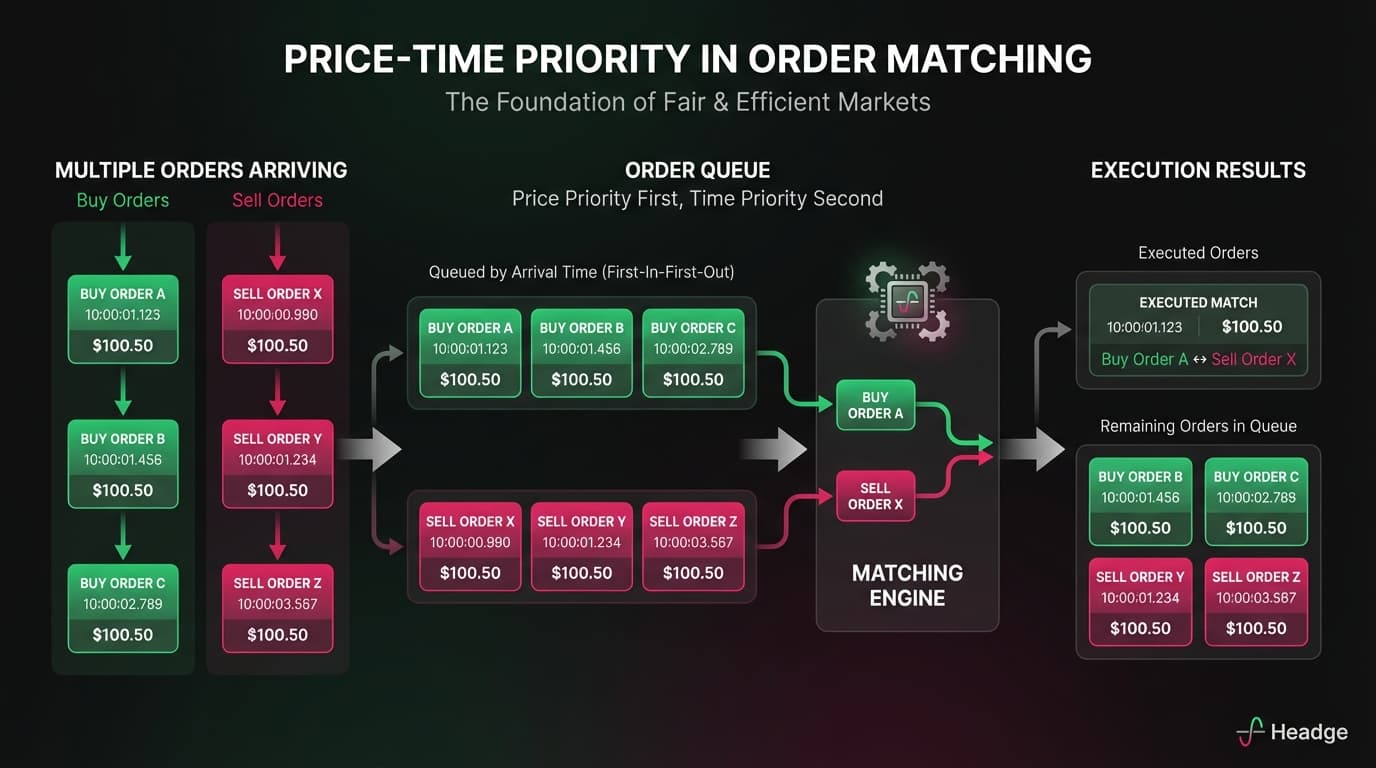

When your market order reaches the exchange, it does not randomly find a counterparty. There is a specific matching algorithm, and in most markets it follows price-time priority. Price priority comes first. The best prices get filled before worse prices. If you are selling, your order matches with the highest bid first. If you are buying, it matches with the lowest ask first. Time priority breaks ties. When multiple orders sit at the same price, whoever arrived first gets filled first. This is why high-frequency traders invest millions in microseconds. Being first in the queue at a price level has real value.

Consider a real example. You submit a market order to buy 5 ES contracts. The order book shows 2 contracts offered at 4500.00, 3 contracts offered at 4500.00, and 4 contracts offered at 4500.25. Your order takes the first 2 contracts because they arrived first at that price. Then it takes the next 3 contracts at the same price. Your average fill is 4500.00 for all 5 contracts. Good timing.

But if those first 2 offers only totaled 4 contracts, you would get 4 at 4500.00 and your final contract at 4500.25. Your average becomes 4500.05. That difference is slippage. In fast markets, this can be significantly worse.

Beyond market and limit orders, there are variations that matter. Stop orders are conditional. They only become active when a trigger price is hit. Think of them as if-then instructions to your broker. Stop-loss orders are the most common type. If the price drops to 4495.00, sell at market. You are attempting to limit your downside. But once triggered, it becomes a market order. In a fast-falling market, you might get filled well below your stop price. Stop-limit orders add a second condition. If the price drops to 4495.00, sell, but only if you can get at least 4494.50. This protects against terrible fills but introduces new risk. In a crash, your order might never execute at all. The market can gap right through your limit price.

Time-in-force instructions tell the exchange how long to keep your order active. Day orders expire at market close. This is typically the default. GTC (Good-Til-Canceled) stays active until you explicitly cancel it. This can be dangerous if you forget about it. IOC (Immediate-Or-Cancel) must execute immediately, entirely or partially. Whatever does not fill instantly gets canceled. FOK (Fill-Or-Kill) is all-or-nothing. Either the entire order fills immediately or the whole thing is canceled.

Most retail traders only need 3 order types: market orders for urgent entries and exits, limit orders for patient entries, and stop-limit orders for protection. Everything else is edge-case optimization.

There are hidden costs beyond obvious fees. Slippage is the difference between the price you expected and the price you received. It is almost always negative. In liquid markets during normal hours, slippage is minimal. In thin markets or during volatility, it can consume your profits. Payment for order flow is another consideration. When you trade through most retail brokers, your order does not go directly to an exchange. It gets routed to a market maker who pays your broker for the privilege of filling your order.

Is this problematic? It is complicated. You often receive price improvement, fills slightly better than the quoted price. But the market maker would not pay for your flow if they were not profiting from it somehow. You are getting a reasonable deal, but you are probably not getting the absolute best deal. Then there is timing risk. In the milliseconds between you clicking buy and your order getting filled, the price can move. High-frequency traders can see your order coming and adjust. News can break. Another large order can sweep the book. This is not paranoia. It is reality.

Every order you place is a tiny negotiation with the market. Market orders say you need this now, name your price. Limit orders say you will wait for your price, take it or leave it. Neither is superior. It depends entirely on what you are trying to accomplish and what you are willing to sacrifice. The traders who consistently lose money are often those who use market orders when they should be patient, and limit orders when they need to act decisively. They optimize for the wrong thing at the wrong time.

Urgency plus liquid market equals market order. Patience plus specific price target equals limit order. Protecting a position equals stop-limit.

Early in my trading, I used limit orders for everything because I had read that market orders were for inexperienced traders. I would miss moves because my limit was 1 tick too low. I would sit watching the market run away while my order remained unfilled. Then I would chase with a market order at much worse prices. Now I think about urgency first. Do I need this trade right now? Is there a catalyst that makes timing critical? Or can I wait for my price? The answer determines the order type. Not some rule I read in a book.

Next up: I will explore the bid-ask spread in depth. It is the invisible tax you pay on every single trade, and it matters more than most traders realize.