Headge Mobile App: Complete Features Overview for Traders

A comprehensive overview of Headge's mobile application features designed specifically for traders seeking to improve their psychological discipline and trading performance.

Headge Team

Product Development

Overview

Headge is a mobile application designed specifically for traders who want to integrate psychological discipline into their trading practice. The app combines meditation techniques, systematic trade journaling, educational content, and performance analytics to help traders develop emotional control and consistent decision-making. Rather than focusing solely on profit and loss metrics, Headge addresses the psychological factors that separate successful traders from those who struggle with emotional decision-making.

Core Navigation Structure

The app organizes its functionality around five main sections, each accessible through a clean bottom navigation bar that remains consistent throughout the user experience.

Home Screen

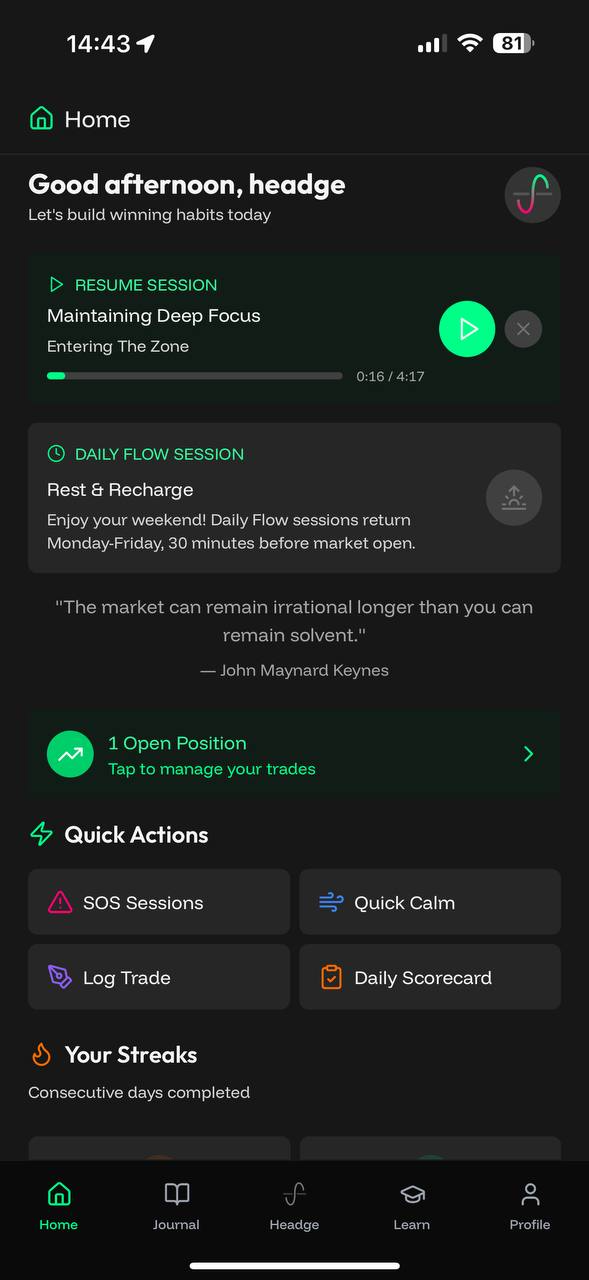

The Home screen provides quick access to daily flow sessions and displays recent trading activity

The Home screen serves as the central hub where traders begin their daily routine. This screen provides immediate access to daily flow sessions, which are meditation practices specifically designed for pre-market preparation. The interface displays recent trading session highlights, allowing users to quickly review their recent performance and emotional state. One of the most valuable features is the resume functionality, which lets traders continue incomplete meditation sessions from exactly where they left off. The screen also includes daily market preparation tools that help traders mentally prepare for the trading day ahead.

Headge Tab

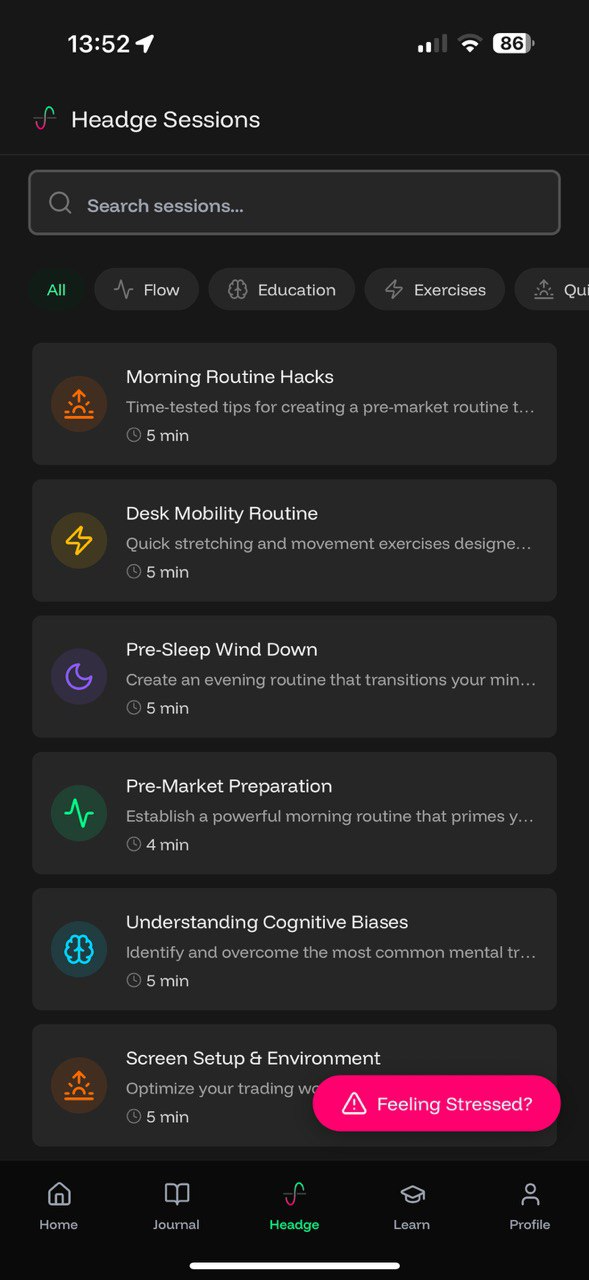

Headge sessions offer immediate stress relief during active trading periods

The Headge tab represents the meditation and mindfulness center of the application. This section houses flow sessions designed for pre-market preparation, helping traders achieve the right mental state before entering positions. Quick calm sessions provide immediate stress relief during market hours when traders need rapid emotional regulation. The SOS sessions serve as crisis intervention tools for trading emergencies, offering specialized guidance for situations like significant losses or revenge trading impulses. All meditation sessions include progress tracking and maintain a complete history of practice, allowing traders to see their consistency over time.

Learn Tab

The 4-week Foundation Course provides structured trading psychology education

The Learn section contains educational content structured around a comprehensive 4-week foundation course in trading psychology. Each week focuses on different aspects of psychological development, from basic awareness to advanced emotional regulation techniques. The weekly modules contain structured lessons that build upon each other, creating a coherent learning path. Progress tracking shows completion percentages for each module, and interactive exercises help traders apply the concepts to their own trading situations.

Journal Tab

Comprehensive trade logging with setup analysis and emotional state tracking

The Journal tab houses a comprehensive trading documentation system that goes far beyond simple trade logging. This section enables detailed trade entry documentation with thorough setup analysis, helping traders maintain objective records of their decision-making process. Trade exit documentation includes emotional state tracking, allowing traders to correlate their psychological condition with trading outcomes. The daily scorecard functionality provides end-of-day performance reviews, while the pre-trade checklist helps ensure systematic preparation before entering positions.

Profile Tab

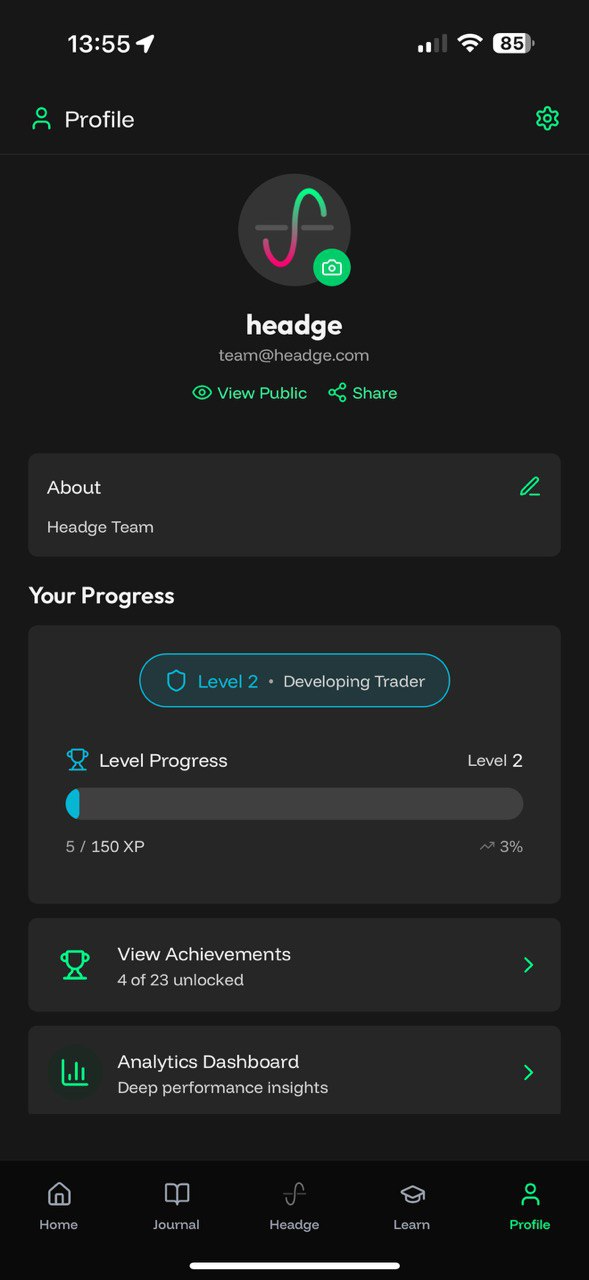

Personal dashboard showing achievement progress and performance analytics

The Profile section serves as a personal dashboard displaying achievement progress and level tracking through a gamified progression system. Performance analytics provide insights into trading patterns and psychological development over time. Account settings and preferences allow for customization of the user experience, while community engagement metrics show how traders are participating in the broader Headge community.

Meditation and Mindfulness Features

Daily Flow Sessions

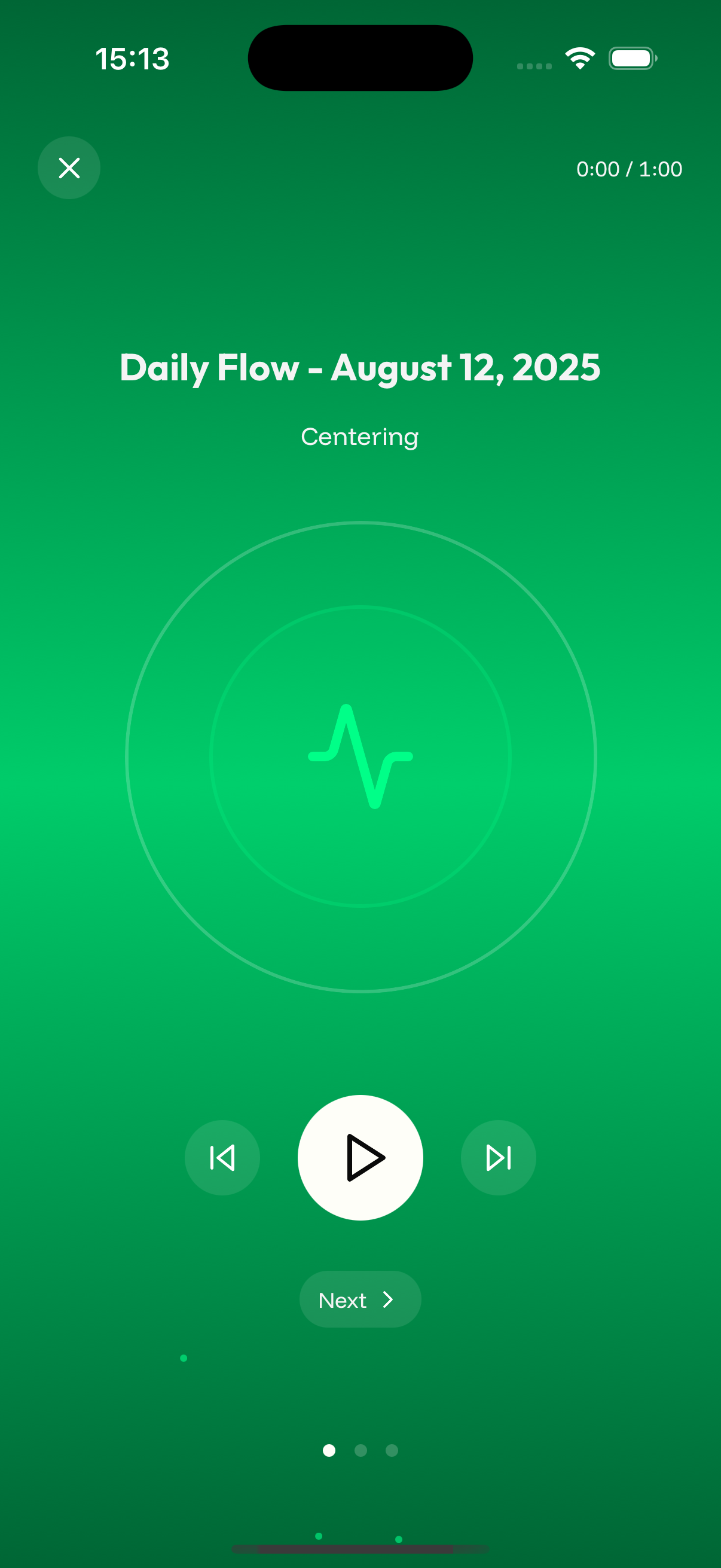

Daily Flow sessions integrate market analysis with mindful preparation practices

Daily Flow sessions represent structured meditation practices specifically designed for traders. These sessions begin with pre-market centering practices that help traders achieve mental clarity before the trading day begins. The sessions integrate market report analysis with mindful observation, teaching traders to process market information without emotional reactivity. Intention setting for trading sessions helps traders establish clear goals and maintain focus throughout the day. Each session includes audio-guided meditation with detailed progress tracking, and the resume capability ensures that interrupted practices can be continued seamlessly.

Quick Calm Sessions

Quick Calm sessions serve as emergency stress-relief tools accessible during market hours when traders need immediate emotional regulation. These sessions typically last between 2-5 minutes, making them practical for use during active trading periods. The breathing exercises provide immediate emotional stabilization, helping traders regain composure during volatile market conditions. The accessibility of these sessions without requiring full login makes them ideal for urgent situations where traders need rapid intervention.

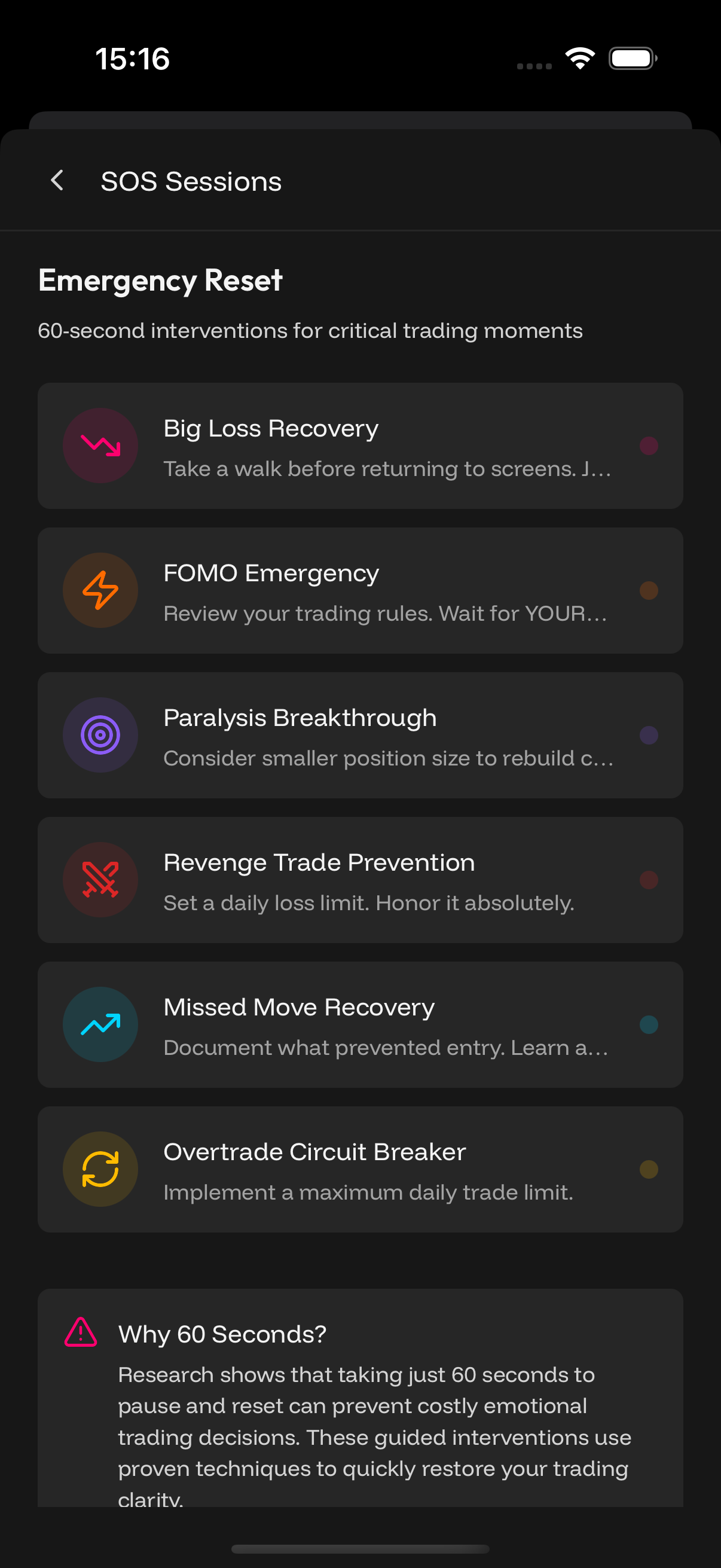

SOS Sessions

Emergency intervention tools for trading crises like big losses and revenge trading

SOS sessions function as crisis intervention tools specifically designed for trading emergencies. These sessions include big loss recovery protocols that guide traders through the psychological aftermath of significant losses. Revenge trade prevention techniques help traders avoid the common pattern of making increasingly risky trades to recover losses quickly. The immediate emotional stabilization features provide structured approaches to regaining psychological equilibrium. Each crisis situation receives specialized audio guidance tailored to the specific type of trading emergency.

Trading Journal System

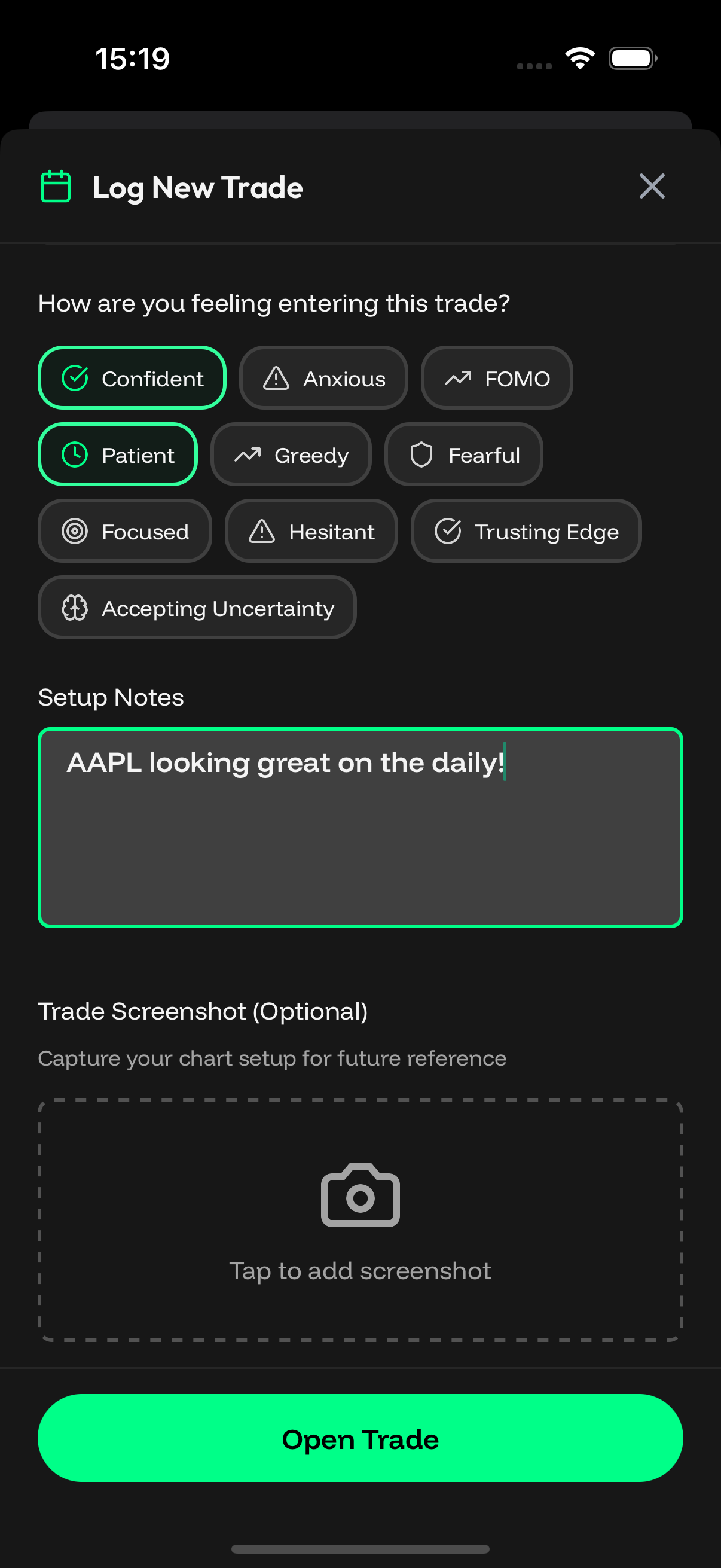

Trade Entry Documentation

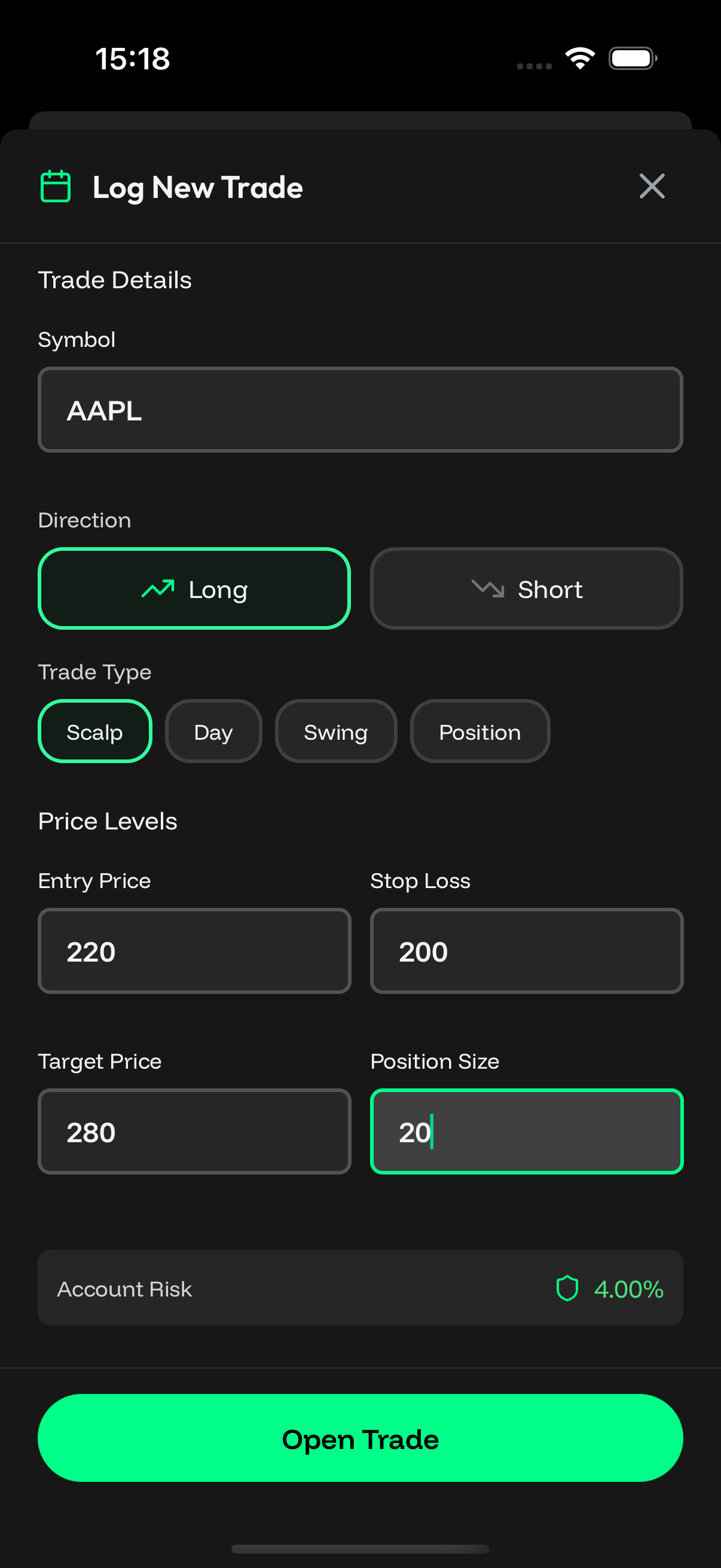

Detailed trade entry form with setup grading and risk-reward calculation

The trade entry system provides comprehensive logging that captures symbol, direction, and position size information alongside entry price and precise timing documentation. Setup quality grading uses a scale from A+ through D ratings, helping traders develop consistency in identifying high-probability opportunities. Pre-trade emotional state assessment allows traders to correlate their psychological condition with trading outcomes. Risk-reward ratio calculation helps maintain disciplined position sizing, while trade thesis documentation ensures traders maintain clear reasoning for each position.

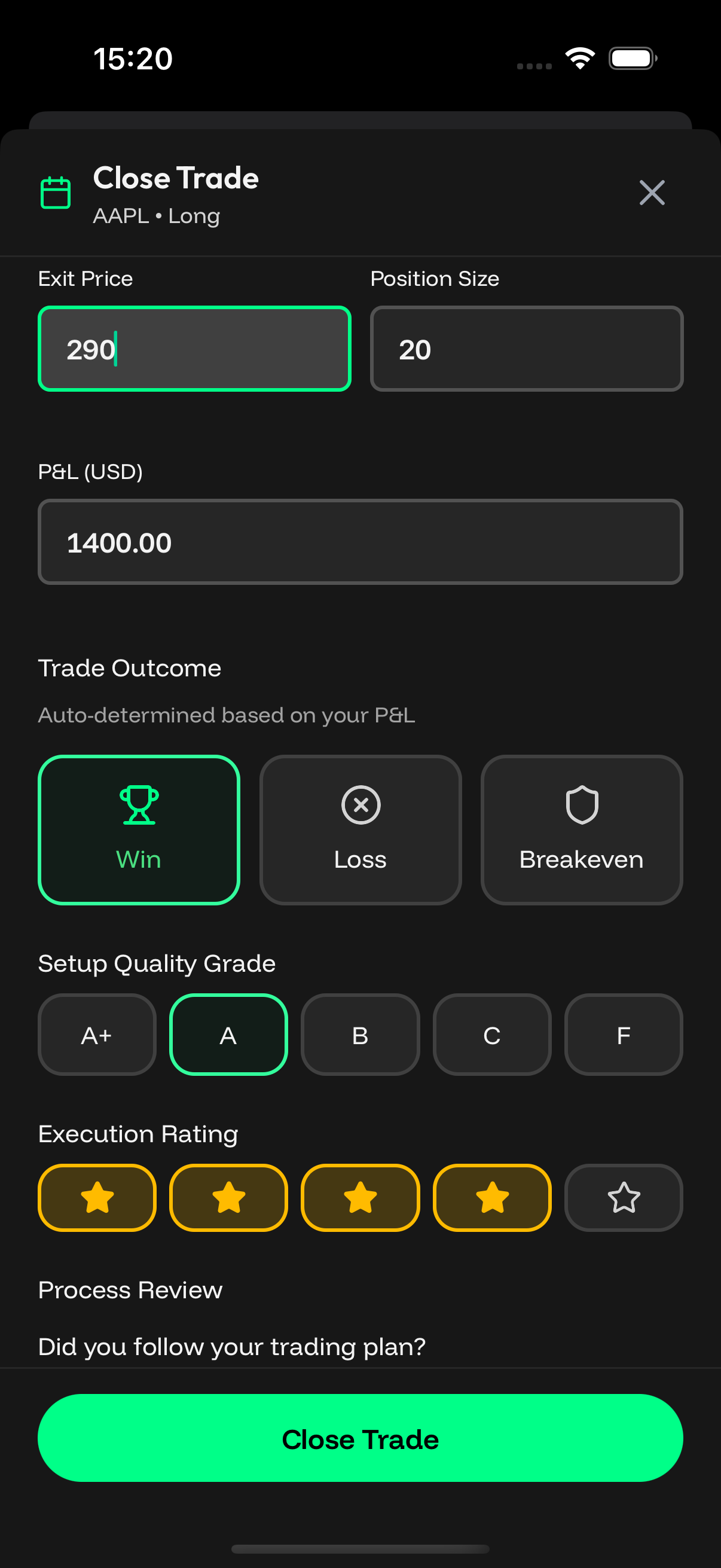

Trade Exit Analysis

Post-trade analysis capturing emotional states and plan adherence

Trade exit documentation captures exit price and timing alongside profit/loss calculations that go beyond simple dollar amounts. Post-trade emotional analysis helps traders understand how their psychological state evolved throughout the trade. Adherence to original plan assessment measures discipline and helps identify areas where traders deviate from their intended strategy. Lessons learned documentation creates a knowledge base that traders can reference to avoid repeating mistakes and reinforce successful behaviors.

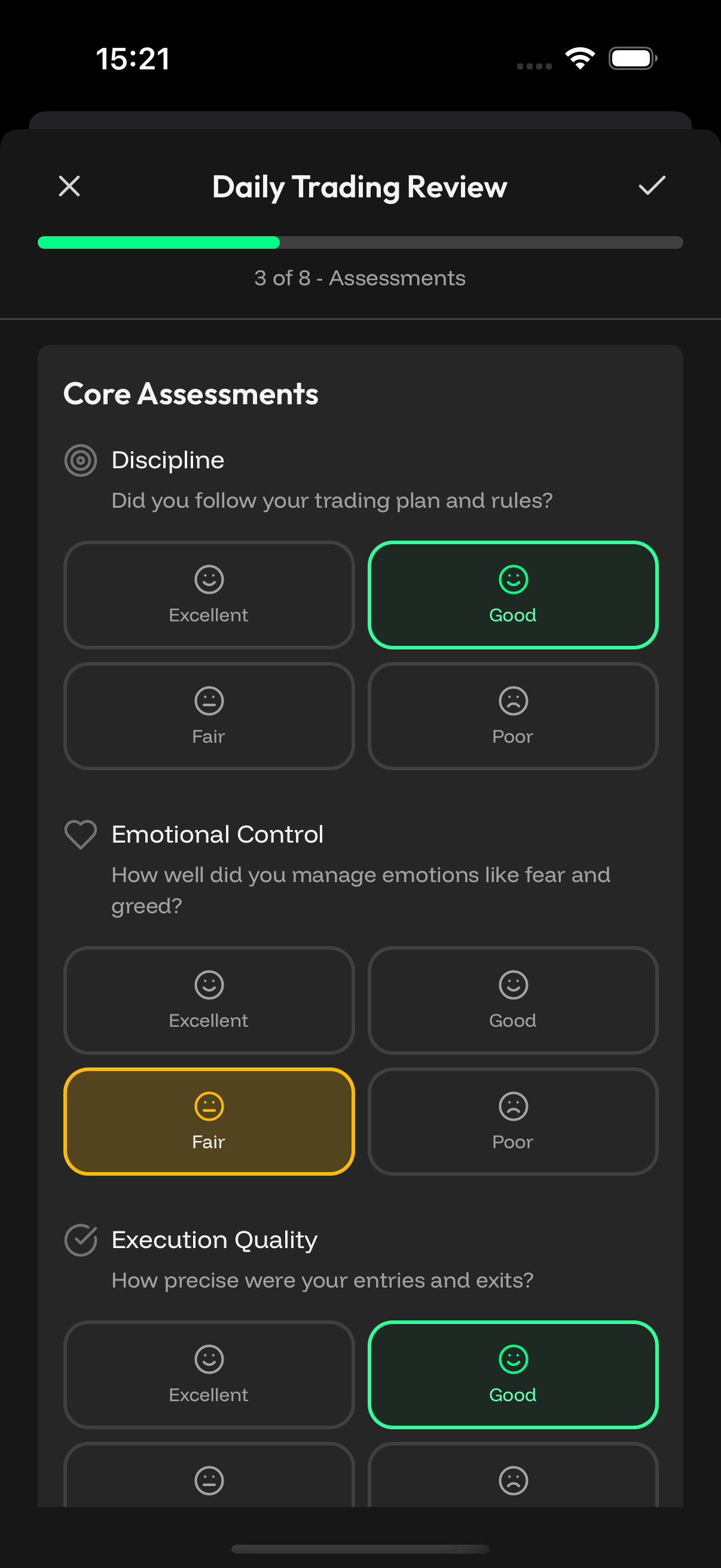

Daily Scorecard System

End-of-day performance review with emotional regulation and discipline scoring

The daily scorecard provides end-of-day performance review through emotional regulation scoring that measures how well traders managed their psychological state throughout the trading day. Discipline adherence rating tracks how consistently traders followed their predetermined rules and strategies. Risk management evaluation assesses whether position sizing and risk parameters were appropriate for market conditions. Overall trading performance assessment combines quantitative results with qualitative psychological factors, while written reflection prompts encourage deeper analysis of the trading day.

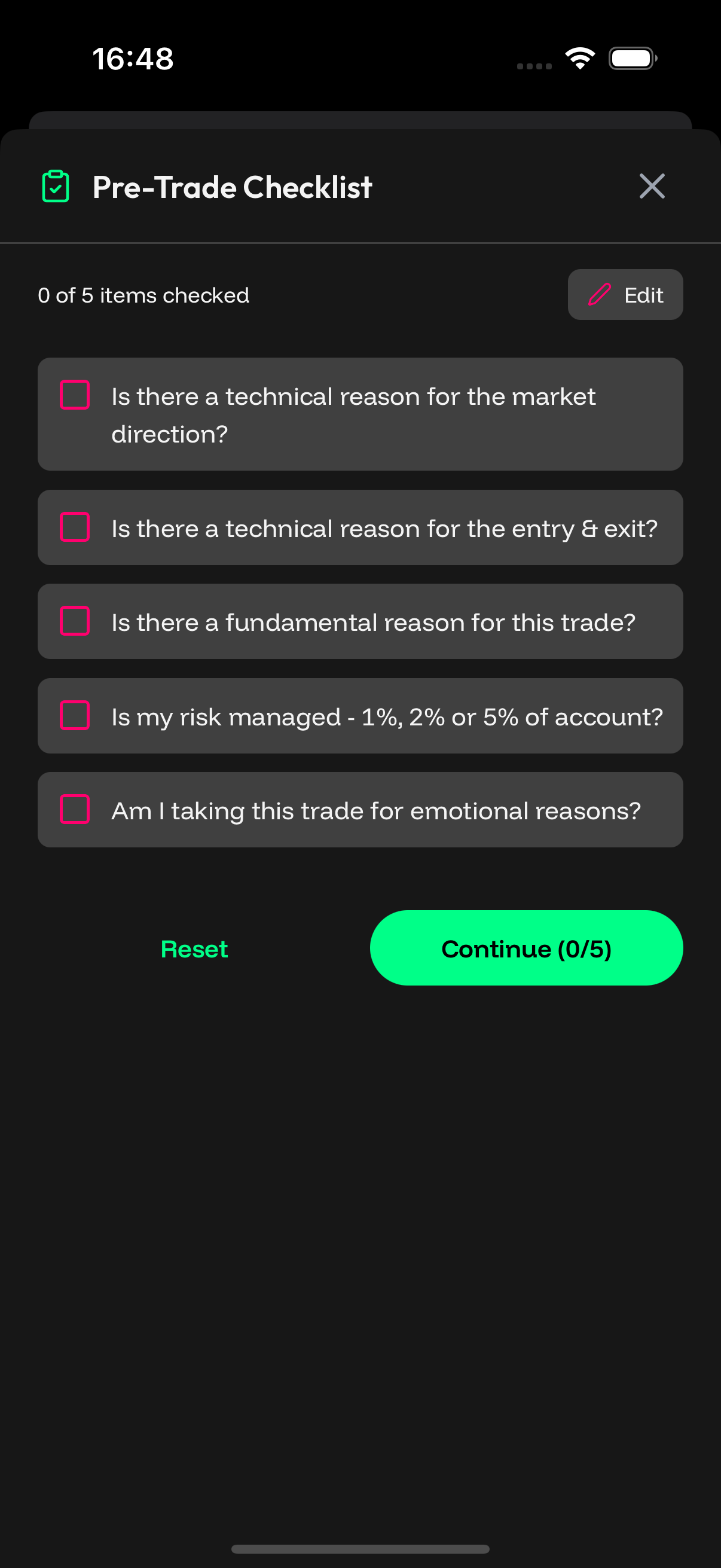

Pre-Trade Checklist

Systematic preparation verification ensuring proper mental state before trading

The pre-trade checklist provides systematic preparation verification through market condition assessment that ensures traders understand the current environment before entering positions. Risk tolerance confirmation helps traders align position sizing with their psychological comfort level. Setup quality verification ensures trades meet predetermined criteria before execution. Emotional state checks help traders recognize when their psychological condition might impair decision-making, while position sizing validation prevents oversized trades that could create undue stress.

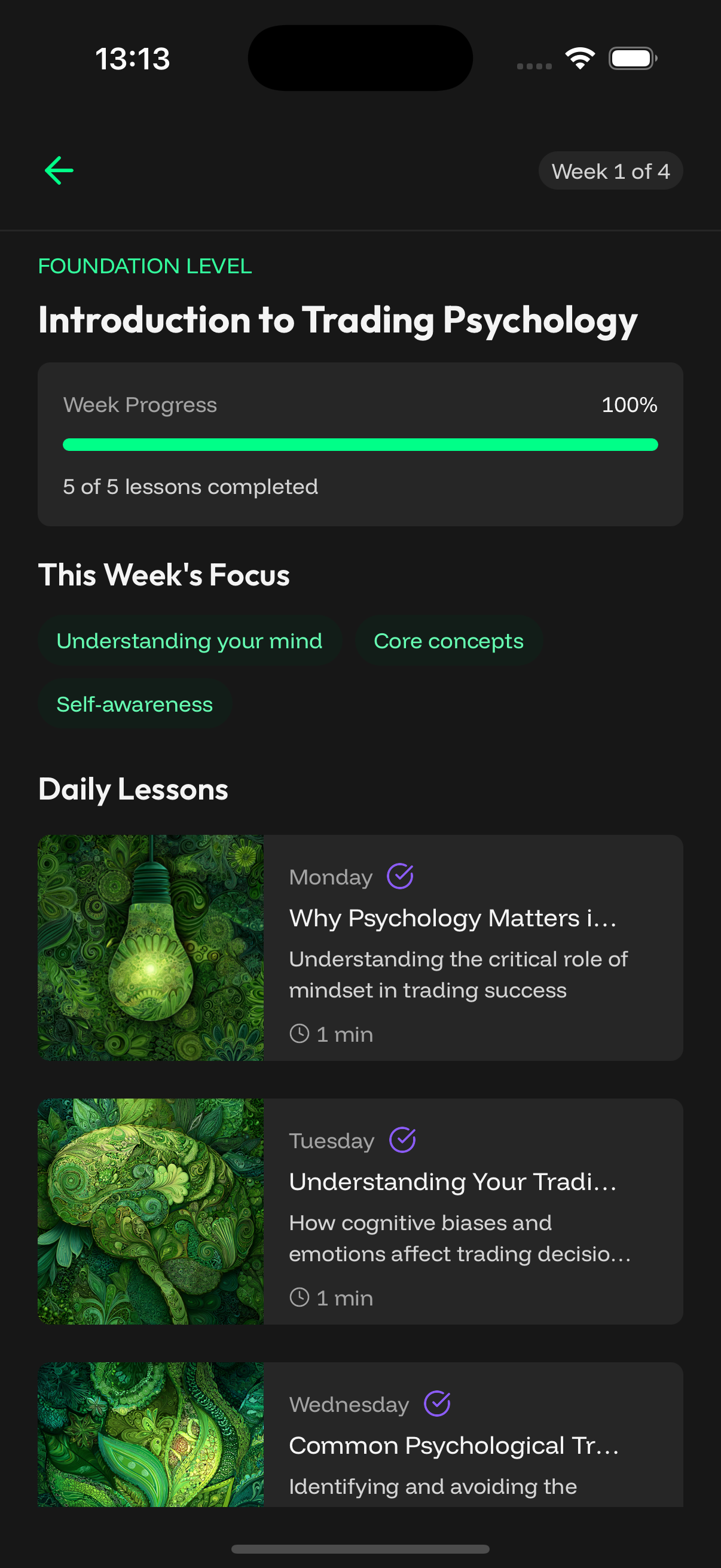

Educational Content System

Foundation Course

Week 1 of the Foundation Course covering trading psychology fundamentals

The foundation course represents a structured 4-week program covering trading psychology fundamentals in Week 1, emotional regulation techniques in Week 2, risk management psychology in Week 3, and developing trading discipline in Week 4. Each week contains 5 daily audio lessons ranging from 10-30 minutes, designed to fit into busy trading schedules. Interactive reflection exercises help traders apply concepts to their specific situations, while progress tracking with completion percentages provides clear milestones. Resume functionality ensures interrupted lessons can be continued from the exact point where they were paused.

Course progression follows a linear path through weekly modules with comprehensive lesson completion tracking. Interactive exercises require written responses that encourage deep reflection on personal trading challenges. The performance rating system allows traders to provide feedback on content helpfulness, ensuring the educational material remains relevant and effective.

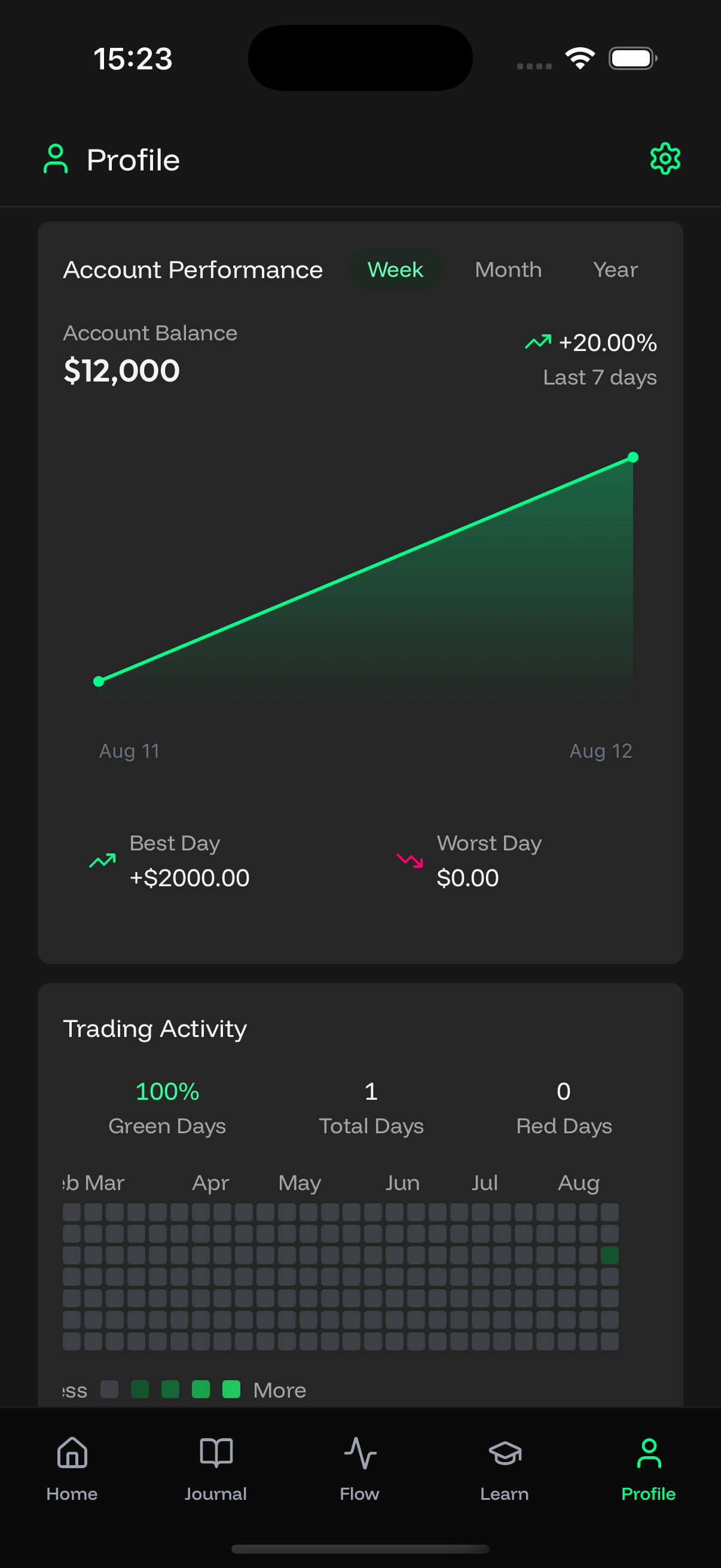

Analytics and Performance Tracking

Performance Dashboard

Comprehensive analytics tracking trading performance and psychological development

The performance dashboard provides comprehensive metrics that track trading performance over time using multiple timeframes and measurement criteria. Win/loss ratio analysis goes beyond simple percentages to examine the quality of wins versus losses. Average risk-reward metrics help traders understand whether their trading approach provides adequate compensation for risk taken. Emotional regulation trends show how psychological control improves over time, while discipline adherence scoring measures consistency in following predetermined trading rules.

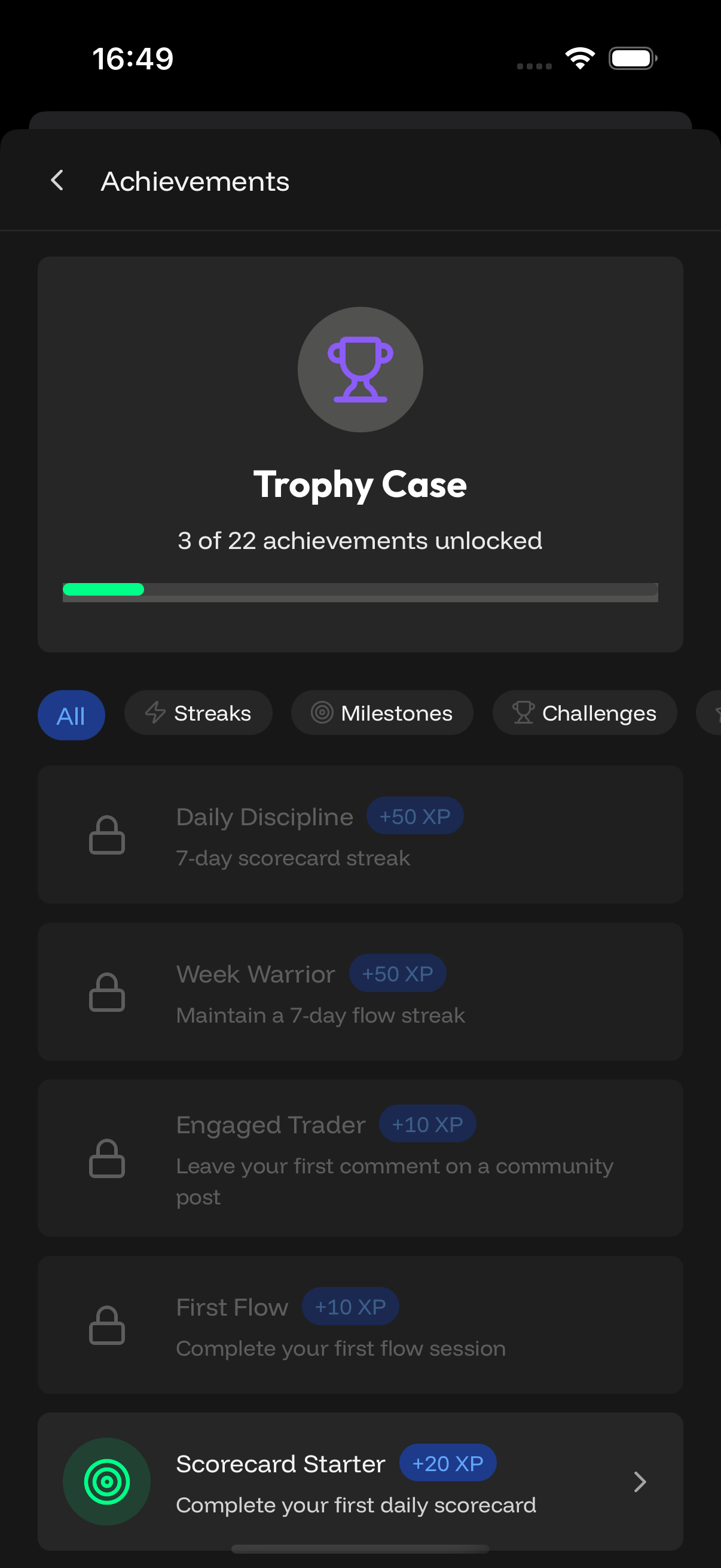

Achievement System

Gamified progression system with achievement badges and experience points

The achievement system implements gamified progress tracking through experience point accumulation that rewards positive trading behaviors. The 10-level progression system ranges from Novice to Master Trader, with each level representing genuine skill development rather than time spent. Achievement badges recognize milestone completion across various categories, from consistency streaks to educational progress. Streak tracking encourages sustained positive behaviors, while community recognition through visible levels creates positive peer pressure and mentorship opportunities.

Progress analytics provide multiple analytical views including daily, weekly, and monthly performance breakdowns that help traders identify patterns and trends. Trade quality distribution analysis shows how setup grading improves over time. Emotional state correlation with performance reveals how psychological factors impact trading results, while session completion and engagement metrics track dedication to the psychological development process.

Community and Social Features

The social learning platform enables community post creation and sharing, allowing traders to contribute insights and learn from others' experiences. The comment system facilitates peer interaction and discussion around trading psychology topics. Experience sharing through written posts creates a knowledge base of real-world applications, while mentorship opportunities develop through level visibility and community engagement.

The public profile system showcases achievement progress and performance statistics in anonymized formats that protect privacy while enabling recognition. Community contribution tracking measures how actively traders participate in helping others, while the peer recognition system acknowledges valuable contributors to the community.

Technical Infrastructure

Audio and Media System

The audio system delivers high-quality playback for guided sessions with background audio support that allows multitasking during longer sessions. Progress saving and resume functionality ensures no meditation practice is ever lost during interrupted sessions.

Data Management

Real-time data synchronization ensures information remains current across app restarts and device changes. Progress preservation maintains detailed records of all activities, while cloud backup protects journal entries and achievement progress. Cross-device accessibility supports both iOS and Android platforms with seamless data transfer between devices.

Notifications and Engagement

The notification system provides daily reminder customization that respects individual schedules and preferences. Session completion tracking maintains accurate records of meditation practice, while achievement unlock notifications provide immediate recognition of progress. Community interaction alerts keep traders engaged with discussions and peer support.

Value Proposition for Professional Traders

Psychological Development

Headge addresses the primary cause of trading failure through systematic emotional regulation training that builds genuine psychological resilience. Pre-market mental preparation protocols help traders enter each day with optimal psychological state. Crisis intervention during market stress provides real-time support when traders need it most. Long-term habit formation occurs through structured practice that creates lasting behavioral change rather than temporary motivation.

Performance Enhancement

The application provides objective performance tracking that extends beyond profit/loss metrics to include psychological factors that drive long-term success. Pattern identification reveals how emotional states correlate with trading outcomes, enabling data-driven improvements in psychological management. The systematic approach to trade preparation and review creates consistency in decision-making processes, while evidence-based improvement strategies use accumulated data to guide development efforts.

Educational Foundation

Professional-grade trading psychology education provides content equivalent to expensive coaching programs. Structured learning progression moves traders from basic concepts to advanced psychological techniques in a logical sequence. Practical application opportunities ensure concepts translate into real trading improvements, while community learning creates peer support networks that extend beyond individual study.

Accountability and Measurement

Daily discipline tracking creates objective measures of psychological development that complement traditional performance metrics. Achievement recognition for positive behaviors reinforces good habits while providing intrinsic motivation for continued improvement. Community visibility creates positive peer pressure that encourages consistent practice, while systematic progress measurement provides clear evidence of psychological development over time.

Technical Requirements and Accessibility

The application requires iOS 14.0+ or Android 8.0+ with internet connectivity for all features including meditation sessions, community interaction, and data synchronization. Microphone access supports audio session interaction for advanced features, while notification permissions ensure timely reminders and achievement recognition reach users when most beneficial.

Headge represents a comprehensive approach to trading psychology that combines evidence-based meditation practices with systematic performance tracking and community support. The application addresses the psychological aspects of trading that traditional platforms ignore, providing traders with tools to develop the emotional discipline necessary for long-term success in financial markets.

James Strickland

Founder of Headge | 15+ years trading experience

James created Headge to help traders develop the mental edge that strategy alone can't provide. Learn more about Headge.